How the Growth of Private Credit is Impacting Private Equity

OfficeHours

AUGUST 25, 2023

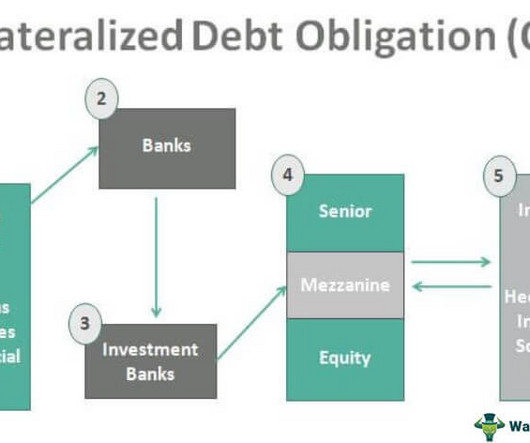

In particular, new guidelines from the FDIC and Federal Reserve (among other governmental agencies) made it more difficult for banks to underwrite financings that resulted in debt-to-EBITDA ratios in excess of 6.0x. This capital is released once investors buy the debt off the banks’ balance sheets.

Let's personalize your content