Understanding the Impact of Interest Rates on Private Equity and Business Valuations

Focus Investment Banking

APRIL 7, 2024

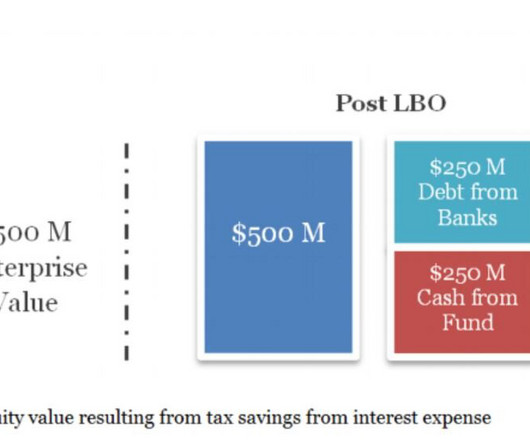

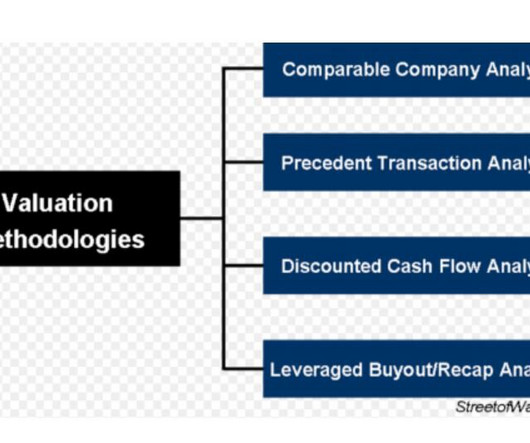

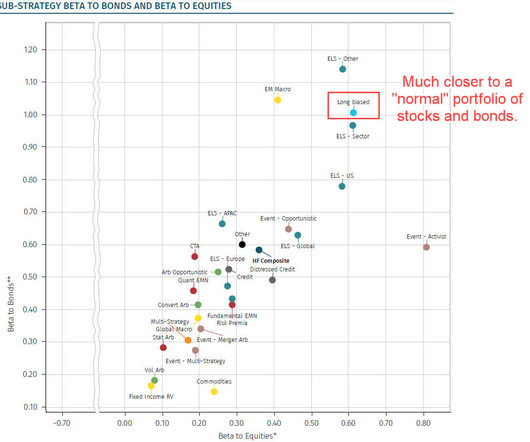

One aspect that is often talked about and significantly impacts the business landscape is the relationship between interest rates, private equity groups, and business valuations. Cost of Leveraged Buyouts: PE firms often use leveraged buyouts (LBOs) to acquire companies, relying heavily on debt financing.

Let's personalize your content