Breathwork, Business, and Big Exits: How Monica Garcia Uses Calm to Crush M&A

How2Exit

JUNE 16, 2025

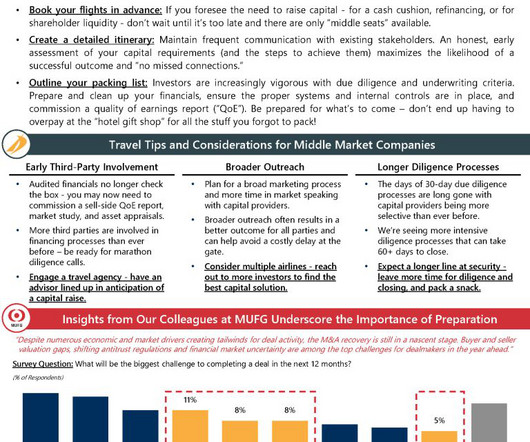

With decades of experience spanning institutional finance, entrepreneurship, and real estate, Monica brings an unmatched blend of analytical rigor and human insight. With a toolkit sharpened by real-world exits, financial modeling, and capital raising, she speaks the language of business fluently.

Let's personalize your content