10 Concepts We Can Learn About Buying Pet Care Businesses From How2Exit's Interview W/ Kevin Moyer

How2Exit

MAY 30, 2023

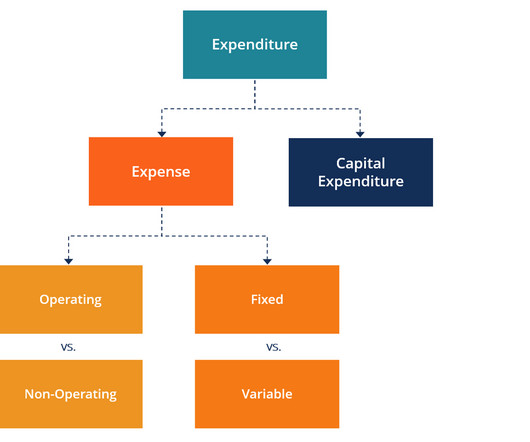

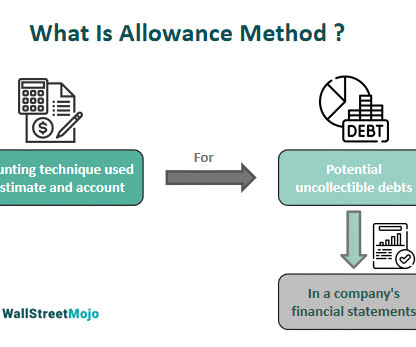

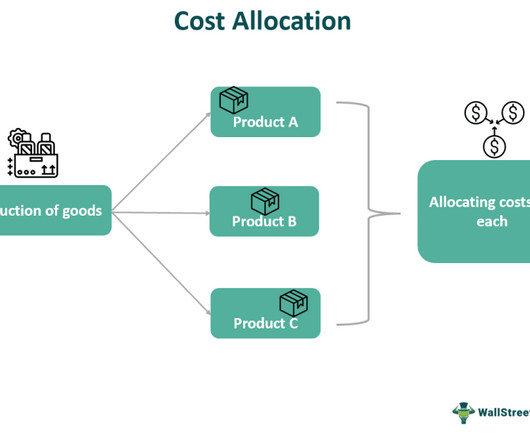

Ron Concept 1: Adjust Out Personal Expenses When it comes to buying or selling a business, adjusting out personal expenses is an important part of the process. This is because personal expenses can be mischaracterized as business expenses, which can lead to inaccurate financial statements and ultimately lead to a bad deal.

Let's personalize your content