FTX and an old blog post

Bronte Capital

NOVEMBER 12, 2022

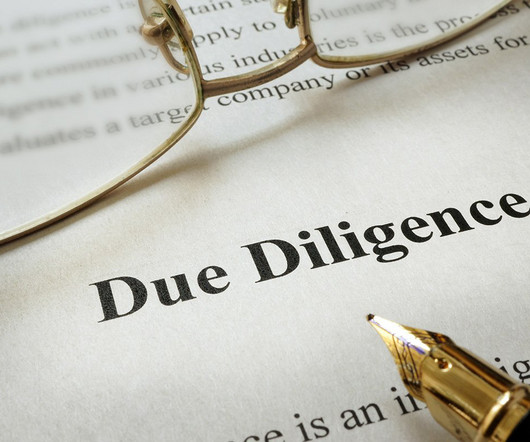

A long time ago I wrote a blog post about rehypothecation with brokers. The 1934 Securities Exchange Act and all that When you sign up to a margin account in almost all cases you pledge your securities to the broker with the ability for them to repledge. It is - unsurprisingly - relevant again.

Let's personalize your content