10-17-2023 Newsletter: How Much Money Should You Have Saved by 30?

OfficeHours

OCTOBER 17, 2023

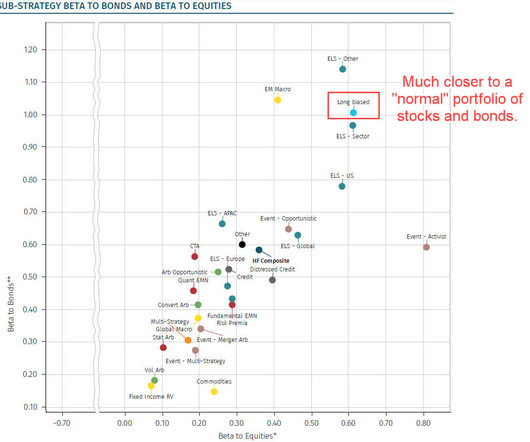

Today’s article will focus on investing and spending considerations for those who are early on in their career and want to maximize how much they are saving in order to pay themselves and cover basic expenses later on in life. Other investments may be more protected from economic impacts and can help with diversification.

Let's personalize your content