Continued Growth in Software and IT Services M&A Expected in 2025

Solganick & Co.

DECEMBER 20, 2024

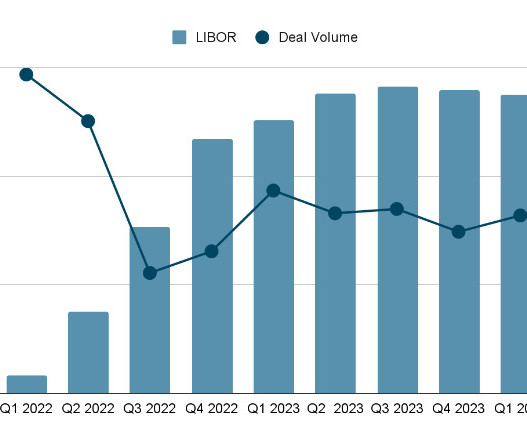

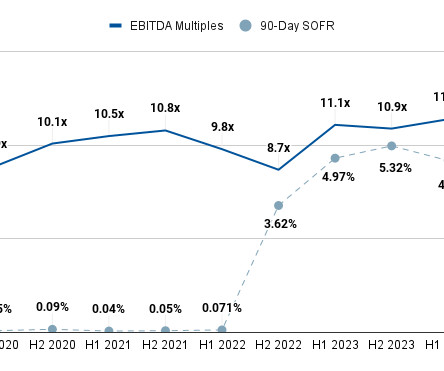

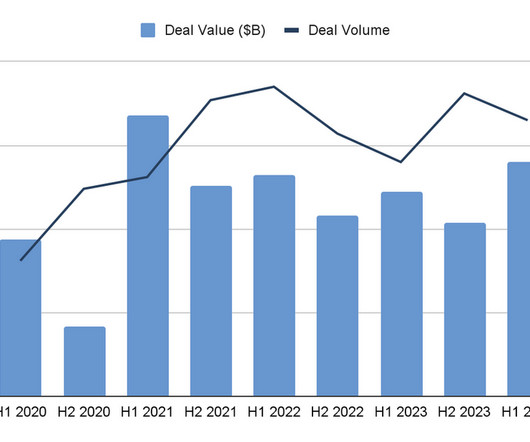

December 20, 2024 – The software and IT services M&A market has seen a rebound in 2024 after a dip in 2023, with a focus on smaller transactions and strategic acquisitions. Cybersecurity Concerns: The increasing complexity of cybersecurity threats is leading to consolidation in the cybersecurity sector.

Let's personalize your content