Greening the Bottom Line: M&A Heats the Race for Sustainable Innovation

Sun Acquisitions

DECEMBER 16, 2024

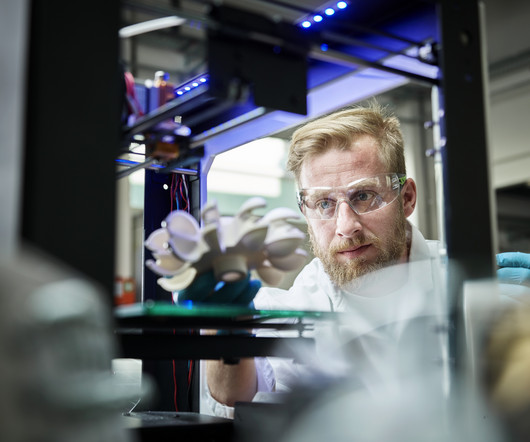

In this race to a greener future, Mergers and Acquisitions (M&A) are emerging as a powerful tool for companies to gain a significant edge. This acquisition allows the company to rapidly enter a new clean energy market, solidifying its position as a sustainability leader.

Let's personalize your content