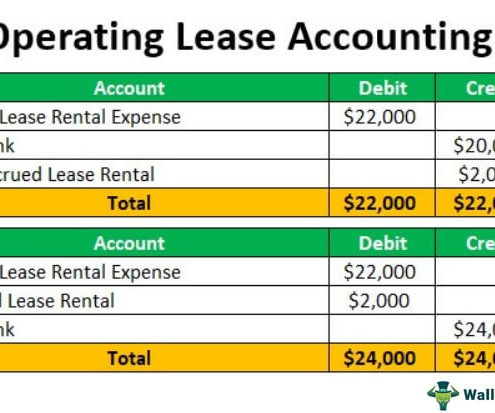

Operating Lease Accounting

Wall Street Mojo

JANUARY 15, 2024

One of the recent developments with respect to this operating lease accounting treatment was observed in 2016 with the evolution of the ASC Topic 842, Leases introduced by the Federal Accounting Standards Board. In contrast, the lessor records the property as an asset and depreciates it over its useful life.

Let's personalize your content