Guiding Entrepreneurs: David Barnett's Comprehensive Approach to Buying and Selling Businesses

How2Exit

MAY 20, 2024

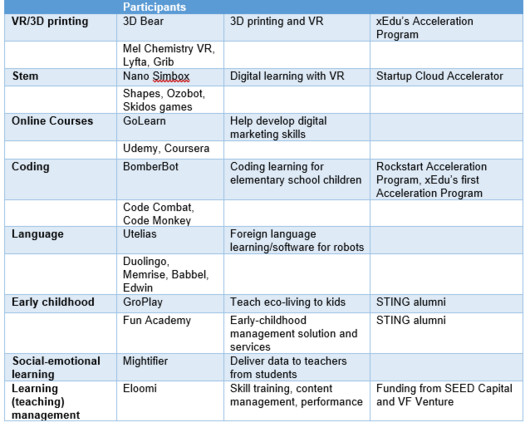

Since 2015, he has been offering consultancy services, assisting clients with transaction analysis for buying or preparing to sell their businesses. He elucidates on the market dynamics, contrasting the more natural debt-equity structures of large companies with the often artificially stimulated small business sector.

Let's personalize your content