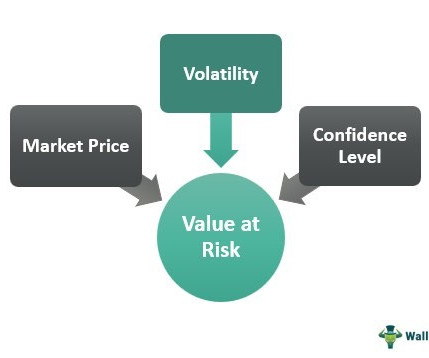

What is Value at Risk (VaR)? Definition and Basics

Peak Frameworks

SEPTEMBER 12, 2023

The choice depends on the nature of the portfolio and the objectives of the risk management exercise. Example: During the 2008 Financial Crisis, many financial models based on parametric VaR underpredicted potential losses, causing significant challenges.

Let's personalize your content