Texas A&M Investment Banking Placement (Using Data)

Peak Frameworks

OCTOBER 4, 2023

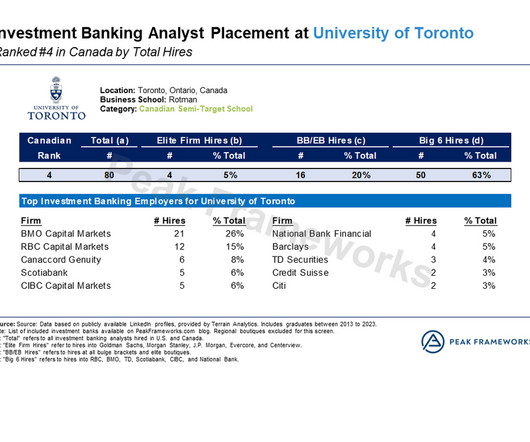

Texas A&M is a public, land-grant research university located in College Station, Texas. Texas A&M is the largest school in the U.S. Texas A&M also has a highly-renowned athletics program and student life. Texas A&M has a respectable Presence score of 41% and an Elite Firm Hires % of 48%. Welsh III U.S.

Let's personalize your content