Gray Knight

Wall Street Mojo

JANUARY 4, 2024

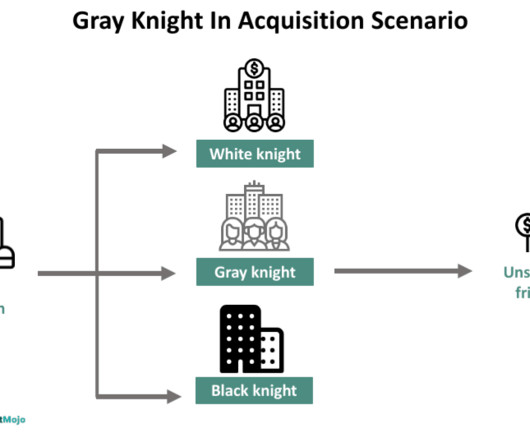

A Gray Knight is an entity that engages in the bidding process for a company takeover without being initially invited to do so. They typically hold potential interest in the target company but initially observe from the sidelines to assess the evolution of the bidding. White knights serve as a defense against hostile takeovers.

Let's personalize your content