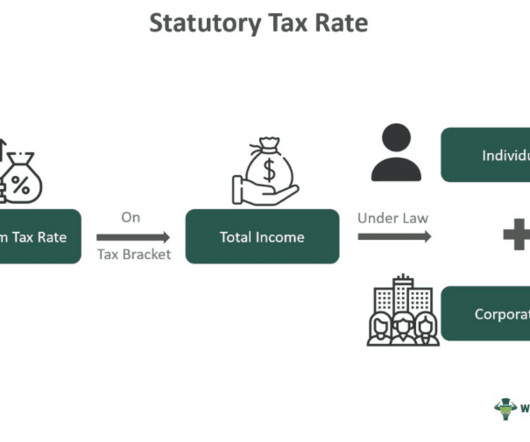

Statutory Tax Rate

Wall Street Mojo

FEBRUARY 9, 2024

What Is The Statutory Tax Rate? The statutory tax rate refers to that rate imposed on an individual’s taxable income falling under a predefined government tax bracket within a tax area. Progressive taxes having tiered statutory rates try to ensure just contribution per income level.

Let's personalize your content