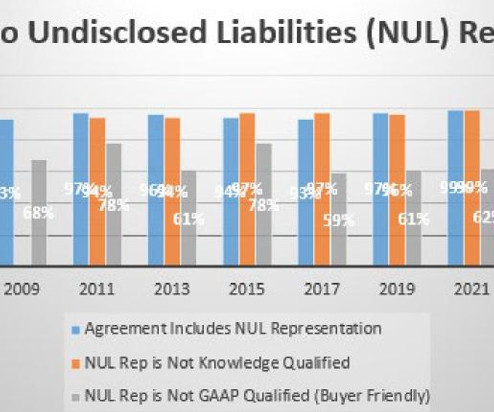

No Undisclosed Liabilities Representations

What's Market

OCTOBER 3, 2022

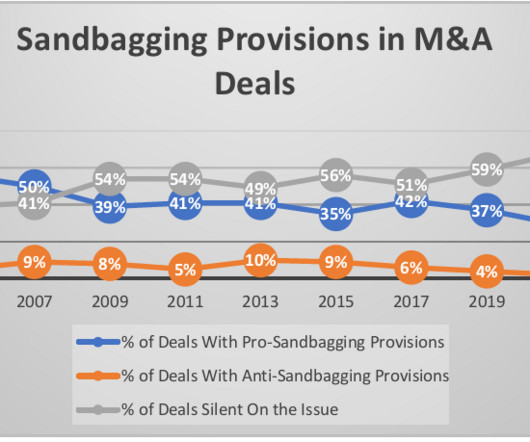

In partnership with Bloomberg Law, Dan has developed a series of 25 articles looking at these trends, on a topic-by-topic basis, providing practical insight into where these trends are heading, and the relevant implications for M&A deal professionals. What Is a No Undisclosed Liabilities Representation?

Let's personalize your content