How Much Is My Insurance Agency Worth?

Sica Fletcher

MAY 15, 2024

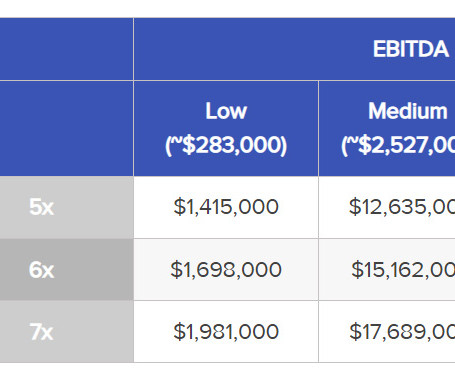

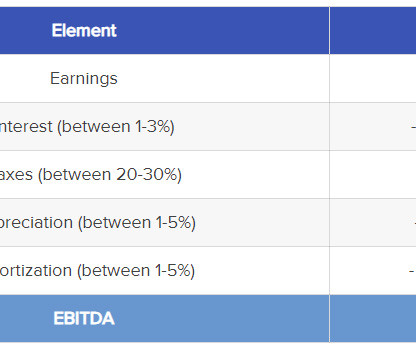

essentially boils down to three major steps: Determine your insurance agency’s EBITDA Determine the standard valuation multiple for an agency of your size Multiply your EBITDA by the multiple to determine your expected payout (i.e., Interest, taxes, depreciation, and amortization are then added to this number.

Let's personalize your content