Liquidnet extends VWAP pre-market block trading functionality to Singapore

The TRADE

FEBRUARY 7, 2024

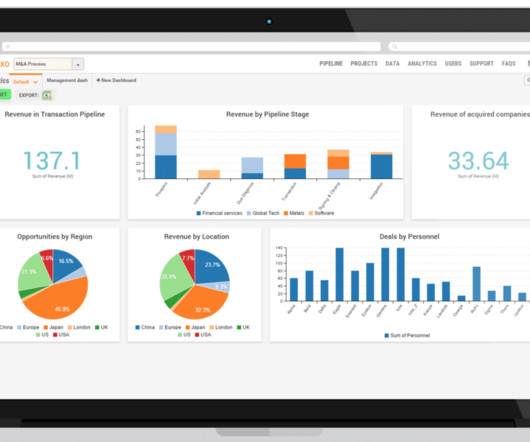

Liquidnet has extended the reach of its VWAP Cross functionality to include the Singaporean market. VWAP Cross is designed to allow Liquidnet clients to cross block size orders at the full day VWAP price prior to market open in a bid to reduce market impact and improve VWAP performance. Baldwin said, speaking to The TRADE.

Let's personalize your content