Why aren’t you running a Risk Register?

Beyond M&A

SEPTEMBER 21, 2023

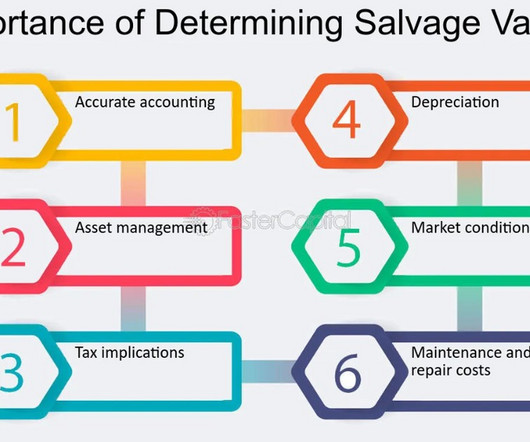

Why a Risk Register Matters Adherence to Best Practices : Ignoring risk and governance is not just an oversight; it’s a lapse in sound business practice. Informative Historical Context : A company’s past governance and risk management behaviours often serve as predictive indicators of future conduct and success.

Let's personalize your content