Understanding Portfolio Valuations: The Backbone of Smart Investing and Risk Management

PCE

NOVEMBER 15, 2023

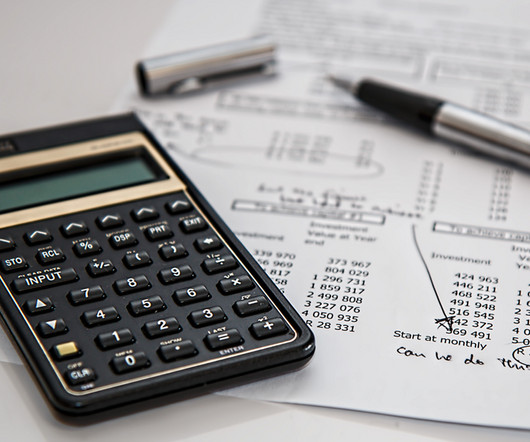

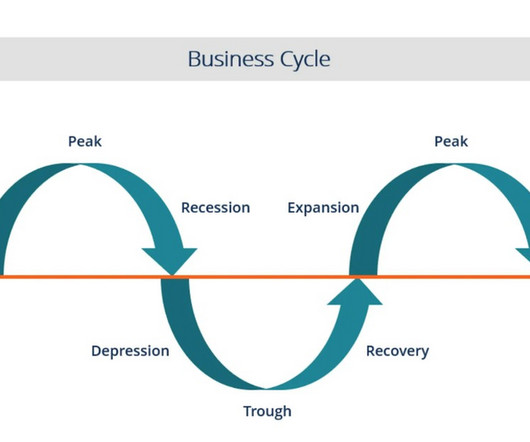

In the complex world of modern finance, the importance of portfolio valuations cannot be overstated. These valuations are crucial for fund and investment managers, as transparency and consistency is important for individual investors, large institutions and other stakeholders.

Let's personalize your content