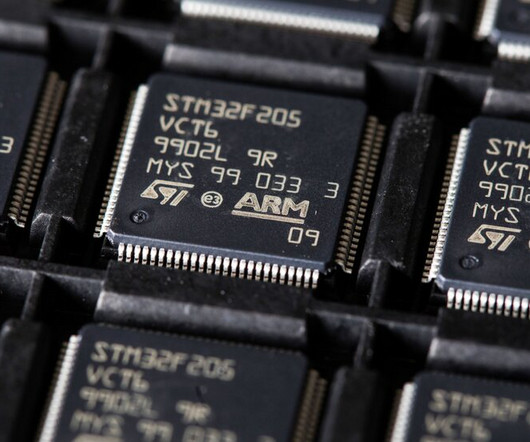

UK chip designer Arm valued at $51 a share ahead of Wall Street IPO

The Guardian: Mergers & Acquisitions

SEPTEMBER 14, 2023

British tech firm valued at $52.3bn before highly anticipated flotation on Nasdaq by private owner SoftBank The British chip designer Arm has secured a $52.3bn (£41.9bn) valuation in its initial public offering (IPO), before its highly anticipated return to the stock market in New York on Thursday. Continue reading.

Let's personalize your content