5 Questions with Stuart Gilson: Creating Firm Value

JD Supra: Mergers

SEPTEMBER 29, 2023

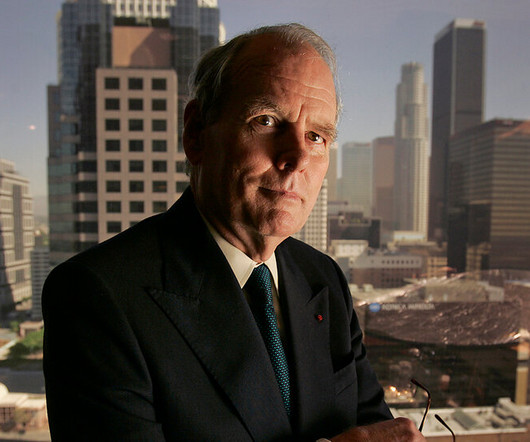

We interview Professor Stuart C. Gilson of the Harvard Business School to gain his insights on how firms create value. Professor Gilson is an expert on valuation, credit and financial statement analysis, and corporate transactions. He has developed several Harvard Business School case studies for teaching MBAs and executives.

Let's personalize your content