European Commission Signals Increased Scrutiny in Semiconductors, AI, Quantum Technologies, and Biotechnologies

JD Supra: Mergers

OCTOBER 17, 2023

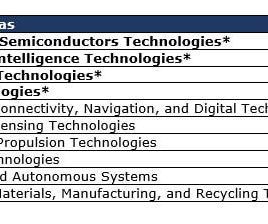

On October 3, 2023, the European Commission ("Commission") unveiled a list of 10 technology areas qualified as "critical" to the European Union's ("EU") economic security, out of which four (Semiconductors, AI, Quantum Technologies, and Biotechnologies) are considered as highly likely to present the most sensitive and immediate risks related to Europe's technology security and technology leakage.

Let's personalize your content