Capital Raise Blog Series - Vol 9 - Types of Capital (Senior Debt & Mezzanine Capital)

RKJ Partners

AUGUST 6, 2017

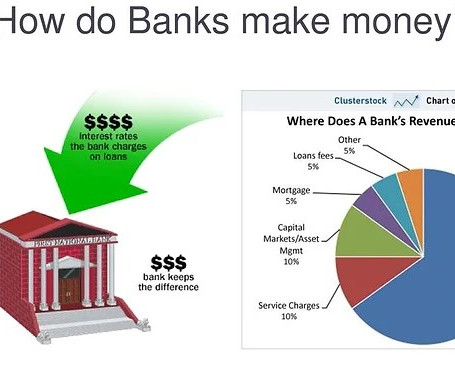

Capital is generally grouped into three main classifications: Senior Debt, Mezzanine Capital and Equity Capital. Most entrepreneurs are very familiar with senior debt offered by traditional banks. Senior debt is first in seniority and is often secured by collateral in the form of a lien.

Let's personalize your content