Profit and Loss Statement

Wall Street Mojo

JANUARY 17, 2024

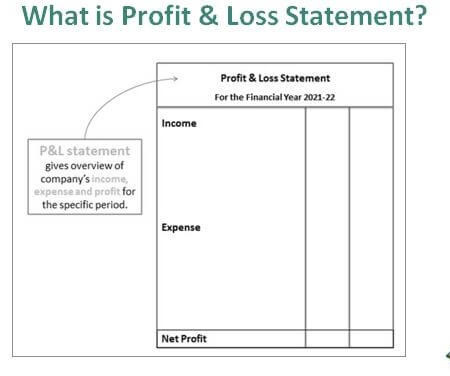

What Is Profit And Loss Statement? A profit and loss (P&L) statement, sometimes called as an income statement, is a financial report that provides investors and outsiders with a financial overview of a company. Table of contents What Is Profit And Loss Statement? Example How To Read?

Let's personalize your content