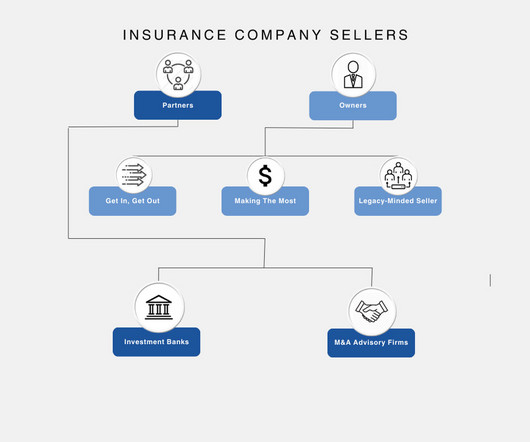

Common Types of Insurance Agency Sellers

Sica Fletcher

APRIL 11, 2024

Your agency valuation will play a large role in influencing how buyers perceive your agency’s worth. Take time before bringing your agency to market to optimize your daily operations, thus increasing the likelihood of a higher valuation. Generally, these fall into two distinct categories of advisory firms or investment banks.

Let's personalize your content