Goldman Sachs becomes second Wall Street bank to raise its S&P 500 target this week

CNBC: Investing

JULY 8, 2025

The strategist's updated forecast puts Goldman among the three most bullish Wall Street firms.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CNBC: Investing

JUNE 27, 2025

banks as valuations grow stretched, Baird says Published Fri, Jun 27 2025 8:48 AM EDT Updated Fri, Jun 27 2025 12:08 PM EDT Sean Conlon @SeanAustin96 WATCH LIVE The recent rally in shares of JPMorgan and Bank of America may soon reverse, according to Baird. banks have outperformed the S & P 500 in 2025.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The New York Times: Banking

MARCH 29, 2024

The S&P 500, rising 10 percent, set the pace as investors looked forward to interest rate cuts.

CNBC: Investing

FEBRUARY 28, 2024

The S&P 500 today is higher quality and has lower earnings volatility than in prior decades, making it a "different animal," BofA's Savita Subramanian said.

CNBC: Investing

APRIL 11, 2025

BofA's advice is to "sell the rips," Hartnett said in his weekly client note looking at money flows on Wall Street.

CNBC: Investing

JULY 8, 2025

Its new price target of $259 implies more than 11% downside for the stock from Monday's close. "To us, upside to JPMorgan's share price from current levels over a multi-year period would seem to require a paradigm shift on how banks are valued," he added. The firm downgraded JPMorgan to reduce from hold.

CNBC: Investing

NOVEMBER 18, 2024

The billionaire investor bought $115 million worth of shares in SPDR S&P Regional Banking ETF (KRE) in the third quarter, making it his seventh biggest holding.

CNBC: Investing

JULY 12, 2025

To be exact, 35 S & P 500 companies and six in the Dow Jones Industrial Average are set to report next week, including two of the largest banks in the country, JPMorgan and Citigroup , both of which report before the market opens on Tuesday. Below are some of the names that floated to the top of the Goldman screen.

CNBC: Investing

NOVEMBER 18, 2024

Even as the investment bank expects a 'return to normalcy' year, its forecast still calls for strong gains for the broad market index.

CNBC: Investing

APRIL 30, 2024

Bank of America's Stephen Suttmeier forecasts headwinds for the S&P 500 in May before a summer rally.

CNBC: Investing

DECEMBER 13, 2023

The bank's expected level implies a nearly 8% gain.

CNBC: Investing

JANUARY 8, 2024

Since bottoming in late October 2023, the "money center" banks reporting this week have outperformed the S&P 500 by an average of nearly 15%. Can this outperformance continue?

CNBC: Investing

FEBRUARY 12, 2025

The investment bank also raised its price target on Doordash.

The New York Times: Banking

SEPTEMBER 19, 2024

The S&P 500 had already been climbing as investors grew more confident that the Federal Reserve would cut interest rates by half a percentage point. Thursday’s gain put the index in range of a closing record.

The New York Times: Banking

JANUARY 22, 2024

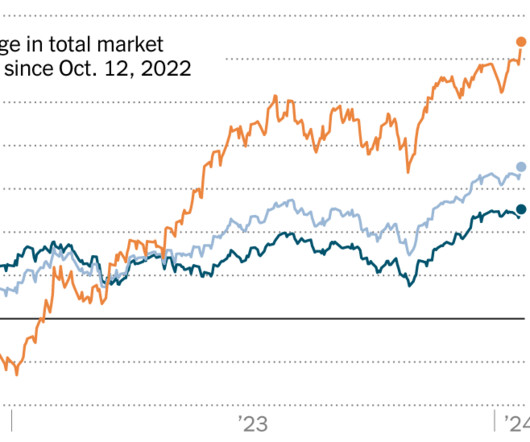

See how a handful of stocks have had an outsize impact on the performance of the S&P 500

The New York Times: Banking

JANUARY 19, 2024

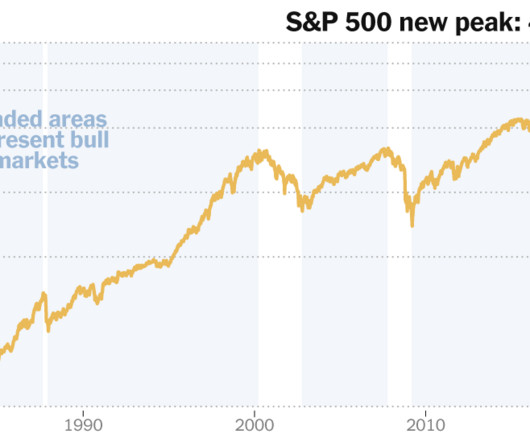

The S&P 500 crossed above its January 2022 peak after weeks of wavering. Investors have been buying stocks after homing in on signals that the Fed’s campaign of raising interest rates is over.

CNBC: Investing

JULY 4, 2023

The investment bank found the top 10 stocks in the S&P 500 were responsible for 32% of the benchmark's return in the average year since 1995.

Global Banking & Finance

FEBRUARY 15, 2024

German lender PBB’s shares plunge after S&P rating cut FRANKFURT (Reuters) – Shares in Deutsche Pfandbriefbank (PBB) dropped 7.5% on Thursday after a cut to its credit rating on concerns over the lender’s exposure to the commercial real estate sector.

CNBC: Investing

SEPTEMBER 9, 2024

Savita Subramanian, the firm's head of equity and quantitative strategy, expects "quality and income are the new growth and P/E expansion."

CNBC: Investing

JUNE 16, 2025

The firm upgraded the digital communications stock to buy from hold in a Sunday note, and increased its price target to $73 per share from $65, suggesting shares will rise 14% from Friday's $64.09 CSCO YTD mountain Cisco Systems stock in 2025. Shares have advanced about 11% so far in 2025.

CNBC: Investing

JUNE 30, 2025

Investors heading into Monday's session were looking at financials as the sector outperforms. " SLR was established in 2014 as part of the Basel III reforms to monitor banks Tier 1 capital. Last week, big banks passed their most recent stress test, but those were reportedly less vigorous than previous years.

Global Banking & Finance

DECEMBER 17, 2024

By Gergely Szakacs BUDAPEST (Reuters) – Hungary’s central bank left its base rate steady at the European Union’s joint highest level of 6.5% S&P Global said on Thursday that central Europe’s monetary easing […]

Global Banking & Finance

SEPTEMBER 9, 2024

stocks moved higher on Monday, following their European counterparts, as markets looked ahead to key data and actions from central banks. The S&P 500 appeared set to snap a four-session losing streak, bouncing back along with the Dow from its biggest weekly percentage loss since March 2022. The […]

The New York Times: Banking

JULY 28, 2023

The S&P 500 is up more than 19 percent this year, but some still warn that the future may not be as rosy as that implies.

The TRADE

JANUARY 22, 2025

I spent the first 20 years of my career at the global bulge bracket banks, first in investment banking and then on the institutional equity desks, in a cross-asset and special situations role. I was there through 2015, then Bank of America, before I joined Conversant Capital in early 2021. It’s been busy.

The New York Times: Banking

AUGUST 5, 2023

Nikola Swan played a key role at S&P when the agency became the first to strip America of its top ranking in 2011.

CNBC: Investing

JUNE 23, 2025

The broad market S & P 500 is up just 2% in 2025, which pales in comparison to the double-digit surges the benchmark saw in 2023 and 2024. After the S & P 500's big two-year run, it only makes sense that U.S. Uncertainty over tariff policy, shakiness on the path of interest rates — and now the U.S.

The New York Times: Banking

AUGUST 5, 2023

Nikola Swan played a key role at S&P when the agency became the first to strip America of its top ranking in 2011.

CNBC: Investing

JUNE 27, 2025

While spreads are tight, lack of competitive yield alternatives, banking sector fundamentals and supply-demand dynamics should remain supportive of the securities, Sileo said in a note Wednesday. Banks account for an estimated two-thirds to three-quarters of total preferred issuance , according to S & P Global.

CNBC: Investing

JULY 11, 2025

Marshall's team identified several stocks with earnings dates this month where the implied move in the options market is low relative to history. Two other companies on Goldman's list set to report next week are Fastenal on July 14 and 3M on July 18. Those stocks are both up about 21% year to date.

CNBC: Investing

JUNE 11, 2025

Here’s what analysts expect Published Wed, Jun 11 2025 1:22 PM EDT Updated Wed, Jun 11 2025 1:33 PM EDT Lisa Kailai Han @lisakailaihan WATCH LIVE Wall Street analysts are optimistic heading into Oracle's earnings release Wednesday after the bell. Strong bookings from OCI customers could continue to boost the company's fundamentals.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content