Corporate Accounting: Meaning, Importance & Explanation

Razorpay

JULY 25, 2023

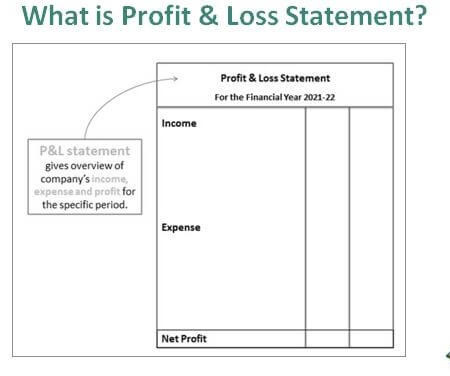

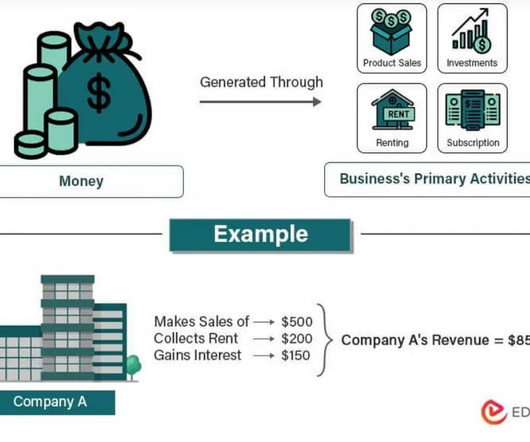

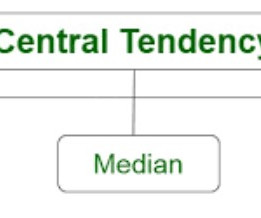

Corporate accounting is a special kind of accounting meant for businesses to record and monitor money movement. It deals with analyzing, classifying, collecting, and presenting a company’s financial data. What is Corporate Accounting? Let’s take a deeper look into the importance of corporate accounting.

Let's personalize your content