Replicating Portfolio

Wall Street Mojo

FEBRUARY 9, 2024

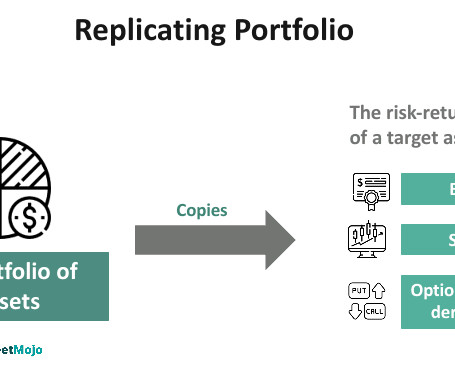

For example, a portfolio has cash flows that match put options in the market. Replicating Portfolio Approach Explained Replicating portfolio involves the pooling of assets in a manner that allows portfolio managers to easily hedge the risks of these assets and balance the risk-return of the target asset.

Let's personalize your content