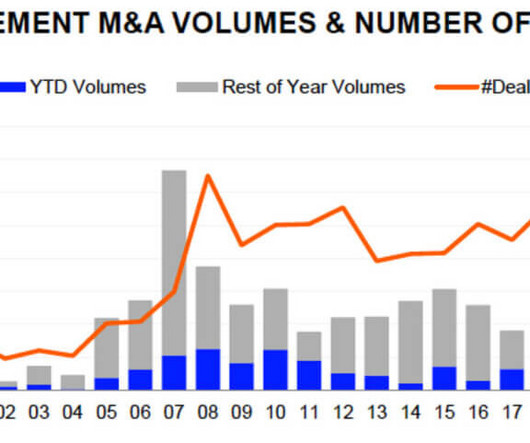

Mastering M&A Valuations: The Comprehensive Guide to Utilizing the Enterprise Value Calculator

Devensoft

AUGUST 22, 2023

Navigating M&A valuations with precision is paramount for informed decision-making. Whether you’re delving into M&A valuations for the first time or seeking to fortify your expertise, this guide offers comprehensive insights and actionable strategies to become a master of company valuation.

Let's personalize your content