A Sharper Focus: Exploring VC Side Letters

JD Supra: Mergers

JANUARY 22, 2025

By: Troutman Pepper Locke

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

JANUARY 22, 2025

By: Troutman Pepper Locke

Mergers and Inquisitions

JUNE 11, 2025

The “tell me about a recent deal” question in finance interviews is designed to test your genuine interest in the industry. I’d summarize the importance of the “tell me about a recent deal” question as follows: Most Important: MBA-level candidates moving into IB from non-finance backgrounds and lateral hires recruiting from non-deal roles.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Growth Business

FEBRUARY 10, 2025

This is especially crucial for finance teams, who can spend up to 84 per cent of their time on manual, low-value activities such as reporting and invoice processing, says Darren Upson, VP of Europe at Tipalti. As they scale, and payment volumes rise, demand for more finance team resource naturally increases.

Software Equity Group

JULY 9, 2025

Prepare for Diligence Early Commission a Quality of Earnings report and prepare detailed data rooms across finance, legal, product, and HR. Third-party reports and clean documentation reduce uncertainty, increase buyer confidence, and streamline the path to close by having answers and materials ready before they are requested.

Mergers and Inquisitions

JANUARY 22, 2025

At the junior levels , entry-level professionals in both fields spend a lot of time in Excel working on models, valuations, and documents such as equity research reports and investment banking pitch books. and areas like corporate finance or strategy at normal companies. public markets roles ( hedge funds , asset management , etc.),

Mergers and Inquisitions

DECEMBER 4, 2024

It mixes public finance , project finance , real estate , and infrastructure. It does help to have industry experience in one of the related sectors (tech/TMT, real estate, infrastructure, public finance, etc.), For more on these points, please see the public finance investment banking article and the analytical examples there.

The TRADE

APRIL 29, 2025

million US instruments across municipal, corporate and government debt, and structured finance, and will reduce reliance on inconsistent and error-prone sources to price securities, manage risk, and comply with regulations. The provider has said that the offering will give clients access to data for 3.6

Mergers and Inquisitions

APRIL 16, 2025

Ill start with a quick summary and then explain the financial impact of tariffs, how theyll affect deal activity, and why they are bad news for the finance job market: Table Of Contents Tariffs & The Job Market: Summary What Do Tariffs Do, and Why Do Countries Use Them? And now tariffs are threatening to derail everything.

Razorpay

JUNE 20, 2025

Inter-Company Fund Transfers: Indian MNCs and startups with global offices need to efficiently manage finances between their parent companies and overseas subsidiaries. Navigating Complex Regulatory Compliance: Managing documentation for FEMA , RBI, GST, and TCS on Foreign Remittance can be a major burden.

CNBC: Investing

JULY 7, 2025

This document is intended for CNBC Pro subscribers only and is not for distribution to the general public. This material should not be construed as a recommendation, or advice or an offer or solicitation with respect to the purchase or sale of any investment.

CNBC: Investing

JULY 14, 2025

This document is intended for CNBC Pro subscribers only and is not for distribution to the general public. This material should not be construed as a recommendation, or advice or an offer or solicitation with respect to the purchase or sale of any investment.

Razorpay

JUNE 18, 2025

These are considered valid when used for work purposes and can be claimed by submitting proper documents as part of the employee expense reimbursement process. Collaborate to Build a Better Policy Involving teams from finance, HR, and management is a smart move. Including this information keeps the reimbursement process transparent.

CNBC: Investing

JUNE 9, 2025

This document is intended for CNBC Pro subscribers only and is not for distribution to the general public. This material should not be construed as a recommendation, or advice or an offer or solicitation with respect to the purchase or sale of any investment.

CNBC: Investing

JUNE 16, 2025

This document is intended for CNBC Pro subscribers only and is not for distribution to the general public. This material should not be construed as a recommendation, or advice or an offer or solicitation with respect to the purchase or sale of any investment.

TechCrunch: M&A

SEPTEMBER 17, 2024

In a statement, Terrance Wampler, group general manager at Workday, said that Evisort’s tech will enable Workday to add a range of AI-powered document processing tools to its existing finance and HR software. “Evisort will help us deliver […] © 2024 TechCrunch. All rights reserved. For personal use only.

Cisco: M&A

JUNE 19, 2025

Decrypting traffic from sites related to personal, finance or healthcare can raise privacy concerns, necessitating careful policy configuration to bypass such traffic. x Documentation — Encrypted Visibility Engine Documentation — Encrypted Visibility Custom Application Detectors We’d love to hear what you think!

JD Supra: Mergers

FEBRUARY 19, 2024

Let’s look at the process of getting a venture financing to closing, and the primary deal documents you can expect to see along the way. Whether you’re a first-time founder or a serial entrepreneur, the process of obtaining venture funding can be complicated and confusing. By: Wyrick Robbins Yates & Ponton LLP

Sun Acquisitions

MARCH 8, 2022

One of the first questions a seller often asks is, “What documents are needed to sell a business?”. We’ve split the required documents as follows: A checklist of the legal documents needed to sell a business. A checklist of the financial documents needed to sell a business. Legal Documents Needed to Sell a Business.

JD Supra: Mergers

MARCH 22, 2024

In the European market, many lenders - particularly investment banks - are focused on ensuring that they have recourse to the underlying assets of the fund via their security documents. By: Cadwalader, Wickersham & Taft LLP

H. Friedman Search

SEPTEMBER 12, 2024

These calls are from senior professionals in the industry of public finance. I can only think that they miss the lifestyle of the public finance banker or bond counsel. They miss the ability to shape the course of public finance projects. It’s the results that stimulate the bond counsels and public finance bankers.

JD Supra: Mergers

MAY 22, 2024

Whether, as part of the management of your startup, you are tasked with driving an equity or debt financing to closing or with gearing up for an exit event, disclosure schedules will be one of the many documents that you will negotiate and deliver as part of your deal.

Business Standard - FInance

JUNE 14, 2023

In order to check fake GST registration, CBIC will assign a risk rating to all applications and tax officers will cross-verify the documents submitted by the applicants with municipal records.

JD Supra: Mergers

JUNE 16, 2023

Each day new limited partnership agreements come across our desks, sent to us by our bank clients who ask us to read and analyze these documents alongside them to determine the most critical question in fund finance: is it bankable?

Business Standard - FInance

JUNE 6, 2023

The report also suggested that REs may adopt Faceless / Straight Through Processes' (STPs) in order to close accounts, and/or accept, acknowledge, and track the communication by the customer

Growth Business

JULY 11, 2023

A management team will need to show they are ambitious, switched on and ready to push the boundaries in marketing, sales and finance. It works well with other forms of financing. Domino’s Pizza and ASOS are two notable names that have raised finance through AIM. This means that larger amounts of finance above £1.5

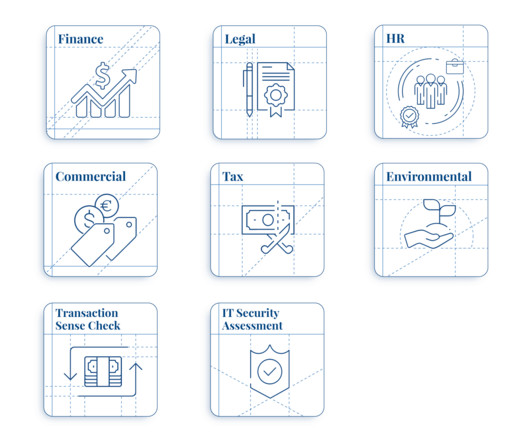

Midaxo

DECEMBER 11, 2023

Historically, M&A playbooks were static documents created at the onset of a merger or acquisition, containing proven best practices and outlining a generic, step-by-step guide to the process. The Evolution of M&A Playbooks A playbook is essentially a roadmap for the M&A process.

Sun Acquisitions

OCTOBER 21, 2024

In the dynamic world of mergers and acquisitions (M&A), financing plays a pivotal role in bringing deals to fruition. For mid-sized businesses eyeing growth opportunities through M&A, understanding the available financing options is essential for success.

Global Banking & Finance

JUNE 28, 2024

Compliance Constraints: Why the finance sector is unable to leverage GenAI By James Sherlow, Systems Engineering Director, EMEA, Cequence Security We’ve seen generative AI (GenAI) deployed in the finance sector across numerous business use cases.

H. Friedman Search

JUNE 21, 2024

If a company asks you to provide further information, such as a business plan for them to consider your candidacy, you must provide those documents quickly and make them very effective. The company must see you as flexible as can be when it comes to any scheduling requirements. About Harlan Friedman, JD & Founding Member, H.

Global Banking & Finance

AUGUST 15, 2023

Germany planning to raise amount of tax relief for firms: document BERLIN (Reuters) – The German government is planning to raise the amount of tax relief it will give to companies in a new draft law that could go to cabinet as early as Wednesday, according to a document seen by Reuters. Chancellor Olaf Scholz’s […]

Global Banking & Finance

SEPTEMBER 6, 2024

By Kate Abnett BRUSSELS (Reuters) – European Union countries are considering delaying the introduction of EU-wide taxes on polluting aviation fuels for 20 years, as they seek a breakthrough on tax reforms that have been negotiated for years with little progress, a draft document seen by Reuters showed.

H. Friedman Search

DECEMBER 14, 2023

As a recruiter, you always get phone calls from professional public finance individuals and bond counsels wanting to know the lay of the land. The quicker I get a return document and the more they accept my guidance, the more I see that they are not just kicking tires but seriously looking to make a move. What do they do?

Global Banking & Finance

NOVEMBER 5, 2024

climate summit on carbon border taxes and other “restrictive trade measures” that Beijing says are hurting developing countries, according to a document seen by Reuters. By Kate Abnett BRUSSELS (Reuters) – China has requested that countries hold talks at next week’s COP29 U.N.

Business Standard - FInance

JUNE 26, 2023

However, ITRs are annexure-less forms, so you are not required to attach any document You would need Form 16, house rent receipt (if applicable), investment payment premium receipts (if applicable).

Global Banking & Finance

DECEMBER 6, 2024

By Stefania Spezzati LONDON (Reuters) – The UK’s Financial Conduct Authority is scrutinising allegations that some former Credit Suisse employees shared confidential information over the WhatsApp messaging platform, documents seen by Reuters show.

European Investment Bank

JULY 23, 2024

Closing the scale-up financing gap is essential for the European Union to maintain its edge in technology. By tracking these firms over time, the report examines the financing they receive and the investors they attract.

Sun Acquisitions

FEBRUARY 20, 2024

Seller financing can be an attractive option for acquiring a business or real estate property. This blog post will explore the critical aspects of due diligence in seller financing deals and what buyers must know to ensure a successful transaction. It offers flexibility in structuring the deal and potentially lower upfront costs.

The M&A Lawyer

AUGUST 23, 2015

An M&A lawyer must also have at least a working knowledge of corporate finance, secured lending, tax, environmental law, employment and labor law, executive compensation and benefits, real estate, antitrust, intellectual property, anti-corruption, commercial law and more.

Global Banking & Finance

NOVEMBER 21, 2024

Here’s why a Capital Markets-focused eVault is vital for safeguarding loan documents, ensuring […] Vervent’s eVault solution provides a powerful, secure digital storage and management platform tailored to the needs of originators, warehouse lenders, custodians, securitizations, investors, and servicers.

Global Banking & Finance

JUNE 7, 2024

5 Reasons Your Finance Business Needs an E-Signature Experience Now E-signature programs offer unique advantages to financial institutions, making signing documents faster, easier, and more convenient. They streamline operations, reduce the risk of incorrectly […]

How2Exit

MARCH 3, 2024

John also discusses the value of documenting standard operating procedures (SOPs) and utilizing technology to streamline processes. rn Documenting standard operating procedures (SOPs) and utilizing technology can streamline processes and improve productivity. rn rn Notable Quotes: rn rn "Brilliant process management is our strategy.

How2Exit

OCTOBER 10, 2023

-Ron rn rn rn About The Guest(s): Juan Braschi is the CEO of Boopos, a company that helps talented buyers acquire businesses and provides flexible financing for buying e-commerce and software-as-a-service (SaaS) businesses. Juan has a background in finance and technology, and he has experience in investment banking and private equity.

Business Standard - FInance

JULY 2, 2023

The bank has now submitted all the required documents, may not invite any penalty

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content