The Unseen Hand: Tariffs and Their Profound Consequences on Mergers & Acquisitions

MergersCorp M&A International

JUNE 5, 2025

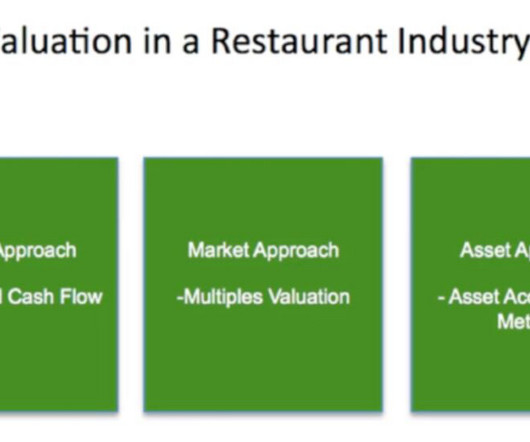

In an era marked by increasing geopolitical tensions and a re-evaluation of global trade relationships, tariffs have re-emerged as a potent tool of economic policy. This increased risk can lead to a higher weighted average cost of capital (WACC) for the target, further reducing its discounted cash flow (DCF) valuation.

Let's personalize your content