Factors impacting Perpetual Growth Rate in a DCF

Wizenius

JUNE 28, 2023

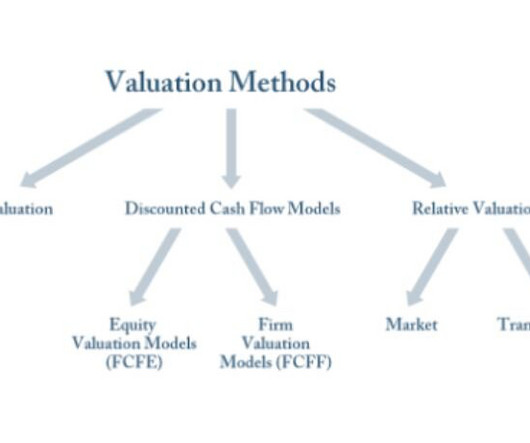

One critical aspect is determining the appropriate growth rate for the perpetual growth phase in a Discounted Cash Flow (DCF) model. Companies like Pfizer and Johnson & Johnson have faced this challenge but have strategically invested in R&D and acquisitions to sustain growth. Start your journey towards success today!

Let's personalize your content