How Issac Qureshi Built an E-Commerce Empire: Mergers, Acquisitions, and Leveraged Buyouts

How2Exit

OCTOBER 28, 2024

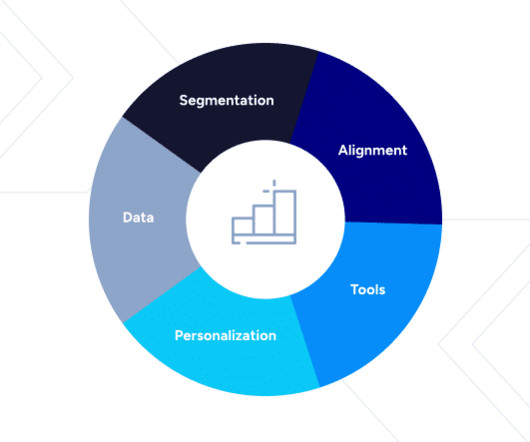

He elaborates on his “four-tweak model,” a measurable approach aimed at significantly boosting business profitability by optimizing traffic, conversion, sales, and costs. Market Leadership through Supplier Collaboration The downstream effect of engaged supplier partnerships is significant.

Let's personalize your content