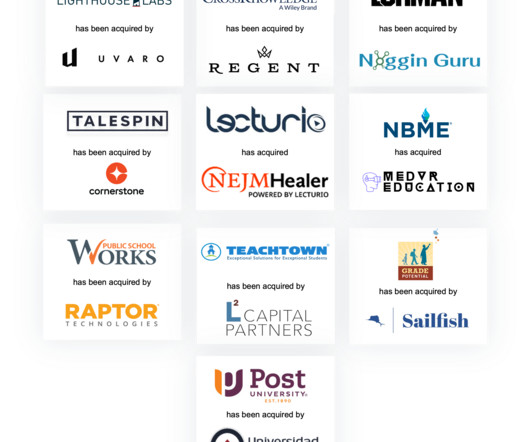

A Lookback: Tyton Partners Last 50 Transactions + Key Deal Takeaways

Tyton Partners

APRIL 10, 2024

Achieve Partners’ social impact focus and deep experience in the digital transformation of education makes them the perfect partner for Elentra to continue to scale its purpose-built platform, and acquire other solutions, to best serve medical and allied health institutions globally.

Let's personalize your content