People Moves Monday: Susquehanna, SEC and Duco

The TRADE

JUNE 23, 2025

He also previously served a separate stint as acting head of the department in 2021.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The TRADE

JUNE 23, 2025

He also previously served a separate stint as acting head of the department in 2021.

Mergers and Inquisitions

DECEMBER 4, 2024

SPAC IPOs for esports companies were “hot” for a short period in 2021, but they seem to have died off by now. Finally, Tifosy is a merchant bank that does a mix of sports advisory and lending/investing work.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CNBC: Investing

JUNE 26, 2025

Extreme heat warnings and advisories are still in effect for parts of the Mid-Atlantic, Ohio Valley and Southeast, affecting 130 million people, the National Weather Service said. Shares are up nearly 12% this week. High temperatures blanketed areas through the central and eastern U.S.

JD Supra: Mergers

FEBRUARY 19, 2025

COMPETITION - Summary of Commission Decision of 28 June 2021 pursuant to Article 7 of Council Regulation (EC) No 1/2003 in Case AT.39914 39914 - Euro Interest Rate Derivatives - Opinion of the Advisory Committee on restrictive agreements and dominant positions & Final Report of the Hearing Officer. By: Mayer Brown

Advertisement

For 12 years Dresner Advisory Services has run analysis on the importance of business intelligence, and the different providers of embedded BI solutions. BI Defined. Business intelligence is the technological capability to include BI features and functions as an inherent part of another application.

Cooley M&A

MAY 5, 2021

Caitlin Gibson has been named to Law360’s 2021 M&A Editorial Advisory Board, which provides feedback on Law360’s coverage and expert insight on how best to shape future coverage. Read the Law360 article here (Subscription required). Contributors. Caitlin Gibson.

Focus Strategies

DECEMBER 13, 2021

Terese Everson, Director, Focus Strategies Investment Banking and Chair of the University of Texas McCombs BBA Advisory Board led the advisory meeting on October 15, 2021. The post Terese Everson Leads University of Texas McCombs BBA Advisory Board Meeting first appeared on Focus Strategies Investment Banking.

Sica Fletcher

FEBRUARY 2, 2022

And What We Anticipate in 2022 2021 is finally behind us, and, as the old curse goes, we still appear to be living in interesting times. 2021 was not an easy year, and now that it's behind us we can't help but wonder what 2022 has in store. Will we see transaction multiples at last year’s levels? Or will the multiples decrease?

Business Standard - FInance

JUNE 2, 2023

The statutory Inspection for Supervisory Evaluation of the bank (ISE 2021) was conducted by RBI with reference to its financial position as on March 31, 2021, it said. The statutory Inspection for Supervisory Evaluation of the bank (ISE 2021) was conducted by RBI with reference to its financial position as on March 31, 2021, it said.

The Harvard Law School Forum

OCTOBER 19, 2022

Posted by Mary Ann Deignan, Rich Thomas, and Christopher Couvelier, Lazard, on Wednesday, October 19, 2022 Editor's Note: Mary Ann Deignan is Managing Director; Rich Thomas is Managing Director and Head of European Shareholder Advisory; and Christopher Couvelier is Managing Director at Lazard. This post is based on a Lazard memorandum by Ms.

Cooley M&A

APRIL 1, 2022

And let’s not forget the extensive recommendations from the SEC’s Investor Advisory Committee addressing SPAC regulatory and investor protection issues that have been under scrutiny. See this PubCo post.)

How2Exit

DECEMBER 11, 2023

He discusses the unique approach and methodologies of Peterson Acquisitions, including their focus on effective sell-side brokerage, buy-side advisory, education, and capital investment. The company offers buy-side advisory services, helping buyers find off-market deals and guiding them through the entire acquisition process.

European Investment Bank

JUNE 23, 2024

In late 2021, Valencia’s municipal housing company (AUMSA) sought a review from EIB advisory services for constructing 323 affordable rental units with gender criteria and nearly zero-energy buildings. Barriers include the underrepresentation of women in STEM and architecture.

The TRADE

JUNE 17, 2024

The move follows a Series A finding round of £15 million in 2021, with this latest investment set to fund the firm’s commercial development, including expanding its sales, product and marketing capabilities in the US, UK, Ireland, Singapore and Australia.

Solganick & Co.

MARCH 11, 2022

has been named by Axial as a top software M&A advisory firm. Following a record-setting 2021 for lower middle market software M&A, the Software Top 50 highlights the most active software-focused dealmakers on the Axial platform. “Public market software company valuations have been battered starting in November of 2021.

Periculum Capital

JULY 15, 2022

Periculum represented the Company in the sale of its grain operations to ADM in 2021. The firm was founded in 1998 to provide sophisticated financial advisory and transaction services. The firm’s primary services include M&A, capital markets, and restructuring advisory, as well as specialized merchant banking services.

Periculum Capital

MAY 11, 2023

Chris Caniff, Senior Managing Director of Periculum, stated “Zainab’s unwavering commitment to the success of this firm over the past decade has been instrumental in the development of our advisory practice. Since joining Periculum in 2021, Taylor has supported client engagements across all service areas.

The TRADE

OCTOBER 21, 2024

Baugh currently serves as managing director, head of European market structure at TD Cowen; a position he has held since August 2021. She also has external roles on industry advisory committees, including the UK FCA’s Secondary Markets Advisory Committee as well as the EMEA and US Quorum 15 Fixed Income advisory boards.

The TRADE

APRIL 4, 2024

The SEC’s order found that from at least January 2019 until December 2021, Senvest employees at multiple levels of authority communicated about company business internally and externally using personal texting platforms and other non-Senvest messaging applications, in violation of the firm’s policies and procedures.

Razorpay

AUGUST 9, 2023

Functions of Merchant Banks A merchant bank’s primary function is to provide financial and advisory services to medium-sized businesses. Morgan Stanley India: Global investment bank with a strong presence in India, offering services such as underwriting, M&A advisory, and equity research.

SDR Ventures

AUGUST 24, 2022

Advisory Panel Members: – Private Equity Investors – Investment Bankers – M&A Accounting Professionals – M&A Legal Firms To watch GF Data’s full coverage of the roundtable event, click here. Looking Forward Among the event’s participants, the consensus is that there will be a surge in M&A activity in 2021.

Periculum Capital

JULY 13, 2023

After successfully opening three new locations in 2020 and 2021, Pet Palace engaged Periculum in late 2022 to run a targeted sell-side process positioning the Company as a premium asset in a highly fragmented market. The firm was founded in 1998 to provide sophisticated financial advisory and transaction services.

Align Business Advisory Services

FEBRUARY 24, 2022

2021 was a record-setting year globally for Mergers & Acquisitions (M&A). With that kind of momentum to carry into 2022, this year is shaping up to be no different. But just because the market is hot, does that mean selling your business is the right move for you now?

Trout CPA: M&A

NOVEMBER 23, 2022

According to BDO’s Life Sciences CFO Survey, 33% of CFOs planned to pursue M&A in 2022, up 25% from the 2021 survey. For life sciences companies, M&A and collaborations are a key strategy for growth, building product pipelines, and getting products to market as quickly as possible.

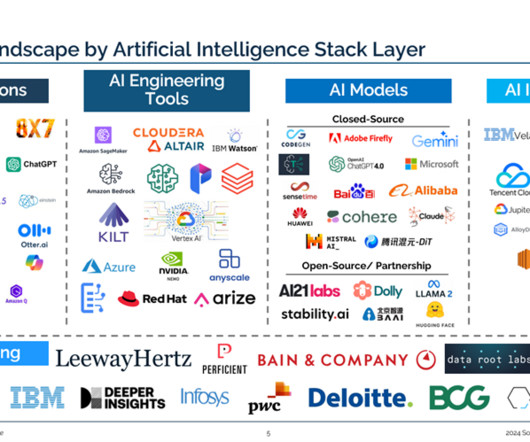

Solganick & Co.

JULY 12, 2024

Acquisitions of AI-related companies in Q2 of 2024 accounted for 195 technology deals, down from 2021 highs but continuing a recent uptrend. The following summarizes the highlights of the report: 2023 was AI’s “year in the sun” as OpenAI’s Chat-GPT exploded onto the consumer scene.

The TRADE

MARCH 4, 2024

Demoulin joined Redburn Atlantic in 2021 having previously served as head of dealing at Verrazzano and as a senior dealer at FrontPoint Partners. Atkins joined Redburn Atlantic in 2004 as a sales trader having previously served for eight years at Morgan Grenfell and two years at Marathon Asset Management.

Periculum Capital

MARCH 11, 2022

"Two of the SHHS owners, Tim Leonard and Michael Shide, shared how important it was to them to get a transaction closed before the end of 2021 even though we did not begin calling potential buyers until August 19th of 2021. The firm was founded in 1998 to provide sophisticated financial advisory and transaction services.

Chesapeake Corporate Advisors

JANUARY 13, 2023

2022 was a strong year for CCA, following a record-breaking 2021. In the video below, CCA Managing Partner, Charlie Maskell, Director, Tim Brasel, and Managing Director, Mike Zuidema break down the CCA team, investment banking, and corporate advisory highlights from 2022.

Transactional Delights

OCTOBER 22, 2021

Rogers-Hixon is the Control Trust Vice-Chair (“The Control Trust Vice-Chair assists the Control Trust Chair in the performance of his or her duties”) Advisory Committee (The current members of the Advisory Committee are: Loretta A. Both the Control Trust Chair and the Control Trust Vice-Chair are accountable to the Advisory Committee.

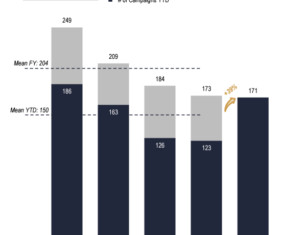

Chesapeake Corporate Advisors

APRIL 8, 2024

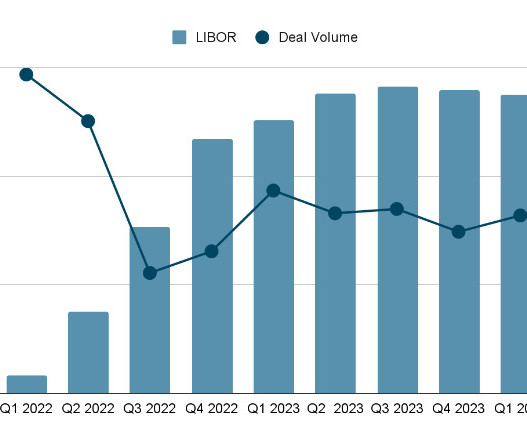

The Bad News Is Not So Bad Rising interest rates and economic uncertainty have tamped down the M&A frenzy that peaked in 2021. Among 420 private equity firms, the number of closed deals dropped from a high of 193 in Q4 of 2021 to a low of 57 in Q2 of this year, per a GF Data mid-year report.

Sica Fletcher

MARCH 31, 2022

In our strategic advisory business on the buy-side and sell-side, we have advised on nearly 400 closed transactions over the past three years. In 2021, for example, the EBITDA multiple paid in advisor-led transactions for companies with over $4 million of EBITDA was 35% higher than for those companies with under $1 million of EBITDA.

Solganick & Co.

OCTOBER 15, 2024

Here is a summary of the report: M&A transaction activity for cybersecurity companies in Q3 2024 improved over the previous quarter but declined from the prior year and remained below levels in 2021 and 2022. Solganick is a data-driven investment bank and M&A advisory firm focused exclusively on software and IT services companies.

iMerge Advisors

APRIL 16, 2025

Valuation Multiples Are StabilizingBut Below 2021 Highs After the correction that began in late 2022, software valuation multiples have largely stabilized in 2024 and are expected to remain steady into 2025. However, they are doing so at a new normal leveltypically 2040% below the frothy peaks of 2021.

The TRADE

FEBRUARY 12, 2024

Prior to joining Aladdin in 2021, he spent nearly seven years at IHS Markit in a sales and solutions role for EMEA, two and a half years at FactSet as its global head of sales and seven and a half years at Thomson Reuters as its head of sales for the Americas.

Solganick & Co.

NOVEMBER 6, 2023

billion, the slowest growth in eleven quarters (since early 2021), and missing analyst expectations of $8.6 Solganick is a data-driven investment bank and M&A advisory firm focused on the software and technology services sectors. Amazon’s entire business generated $11.2 Google Cloud Google Cloud’s Q3 2023 revenue rose 22.5%

Sica Fletcher

APRIL 2, 2024

Granted, these numbers are not quite at pre-pandemic levels yet (although they are close), and they are nowhere near the M&A boom of 2021. In deals with the highest earnout, business owners turn to a specialized M&A advisory firm to handle negotiations and oversee valuations.

Cooley M&A

JANUARY 25, 2023

Although 2022 saw a general decline in M&A activity in the life sciences industry compared to 2021’s frenetic pace (when deal volume was up 52% from 2020 ), life sciences deal flow in 2022 on balance remained strong despite the headwinds. Let’s dig in.

Trout CPA: M&A

JANUARY 7, 2022

Now that 2020 and 2021 are behind us, businesses can see how the pandemic has or will be affecting their operations. Then came the COVID-19 pandemic in early 2020 and the ensuing chaos in business – shutdowns, government assistance, labor problems, and most recently, the supply chain disruption.

Solganick & Co.

OCTOBER 28, 2022

magazine’s “Founder-Friendly Investors” list in 2020, 2021, and 2022. Solganick offers strategic and financial advisory and relationships within the software and tech-enabled services industry sectors, a deep knowledge within these sectors, and a premium team of experienced investment banking professionals. Solganick & Co.

Accenture Capital Markets

OCTOBER 13, 2022

A quick recap based on numbers Eight months ago, we found wealth management firms in Asia wanted to nearly double assets under management (AUM) by 2025 from 2021 levels and grow revenues nearly 60 percent. Let me explain why I believe this is the case.

Accenture Capital Markets

AUGUST 23, 2022

The firms we looked at as part of our research also included companies which in 2021—a very benign year for markets—managed to grow their AUM up to five times faster than some of their peers. tn, of which approximately 40% was being held in cash in 2021. The common factor differentiating these leaders from others?

Tyton Partners

APRIL 15, 2024

Enrollment in ESAs grew gradually, reaching ~30,000 enrolled students in 2021, ten years after their inception, before more than tripling enrollment nearly overnight on the tail end of the pandemic. Key findings from Paying for Choice 2024: Parts 1 and 2 include: ESA programs are projected to cover approximately 10.2

Accenture Capital Markets

MAY 9, 2023

However, the attractiveness of the recordkeeping business is waning for many providers: administration fees have continued to decrease, and the value that was once captured in fund advisory has been largely eroded with the rise of passive products.

Viking Mergers & Acquisitions

MAY 4, 2023

Having his father as a role model has allowed Jacob to gain empathy for his clients and pursue successful business transaction advisory to aid families and individuals as they fulfill their exit strategy through Viking. Jacob was drawn to the dynamic family atmosphere and accountability that came along with a career at Viking.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content