Servexo Open to Grow With Ideal Capital Partner

The Deal

FEBRUARY 2, 2024

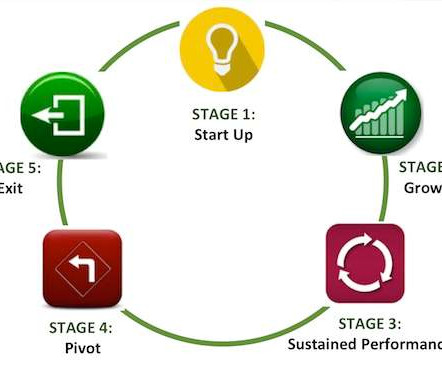

has been bootstrapped since it was founded in 2012 and incorporated in 2013. While the company is profitable and growing and should continue on that path with or without a capital partner, company president and co-founder John Palmer said the right capital partner could help expedite its growth trajectory.

Let's personalize your content